Your startup team from idea to growth

VisionX Partners starts, builds, markets and runs your startup from the ground up.

What our

entrepreneurs

say.

Featured & Mentioned In:

Building and running a profitable and impactful startup requires a committed team.

A team that’s not only committed to building a functional and nice-looking product but one that customers need and pay for.

VisionX Partners takes all of those responsibilities and more to start, build, launch and run your startup so you can focus on what you do best while we focus on what we’ve proven to be great at.

Our Solutions &

Process.

Validation

Idea Validation

Market Research

Go To Market Strategy

Product Development Roadmap

Product & Launch

User Experience Design

Product Development

Customer Acquisition & Sales

Business & Partnership Development

Innovation

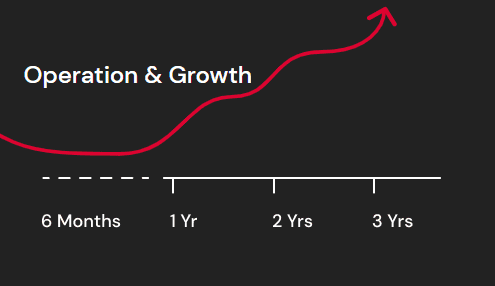

Operation & Growth

Development & Design Agencies/Freelancers

- Defining project scope

- Development and design

- Entrepreneur responsible for marketing and sales

- Entrepreneur responsible for operation

- Entrepreneur responsible for partnership development and fundraising

- Entrepreneur responsible for growth

- Product validation, launch strategy, roadmapping and feature selection

- Data-driven development and design

- Working with entrepreneur on customer acquisition and sales

- Running the startup alongside the founder(s)

- Working with entrepreneur on partnership development and fundraising

- Dedicated startup team for growth

Every startup is unique. Contact us for more insight into how we would approach building yours.

Case Studies.

Creating a fun shopping experience with a powerful and safe scooter booked on-demand.

Stage

Product on the market with paying customers

Performance

Scoozer is now available in 11 cities and has facilitated over 10,000 rides.

“Despite the complexity of the product, distribution, insurance and regulatory challenges, we’re successfully launching Scoozer.”

Samuel D. Wachsman

Founder and president of Stalwart Equities and Scoozer

Virtual reality parachute flight simulator for training agencies, students and entertainment.

Product on the market with paying customers

Over 11,000 landings by military training agencies, drop zones, VR cafes, aspiring and professional skydivers.

“Working with VisionX Partners has lifted weight off my shoulders."

Ronnie Hughan

Co-founder of SkydiVR

Latest Partnership:

Trella Technologies, creator of TrellaGro LST – the first patented automated horizontal plant training solution to grow tall plants indoors, no matter the climate.

Click below to learn more about Trella’s units and most recent product updates and launches.

VisionX Partners is for you if you value your time, focus on results and love starting and delegating new ventures.

Startup Insights & Tips.

6 Decision-Making Principles for Startup Founders

Content Marketing Guide for Startups

Startup Communication and Negotiation Guide

Our Latest Forbes Posts.

- 5 Startup Opportunities In Digital Banking

In this article, we look into five niches within digital banking that present opportunities for new innovative startup projects.

- 5 Startup Opportunities In Influencer Marketing

Here are five interesting niches within influencer marketing that present great business opportunities for innovative startups.

- 5 Startup Opportunities In Genomics

In this article we delve into five particularly promising areas within genomics where startups able to innovate are quite literally likely to change the world.